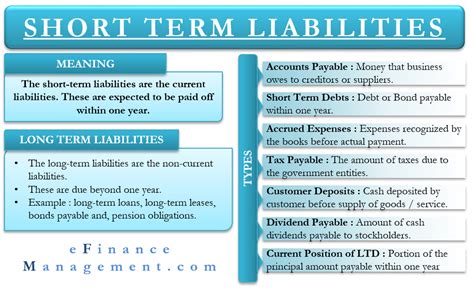

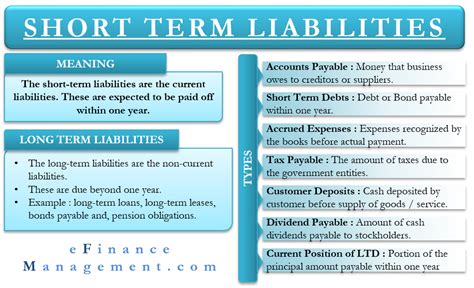

short-term debt & capital lease obligations hermes | short term liabilities examples short-term debt & capital lease obligations hermes Short-term debt is any debt obligations that a company needs to pay back within the next 12 months or within the current fiscal year. It includes accounts payable, lease . Enclaves. 8455 W Sahara Ave. Las Vegas, NV 89117.

0 · short term liabilities vs long

1 · short term liabilities examples

2 · short term debts examples

3 · short term debt vs long

4 · short term borrowings current liabilities

5 · short term assets and liabilities

6 · examples of short term loans

7 · current short term liabilities include

DEMO - eparaksts.lv . demo

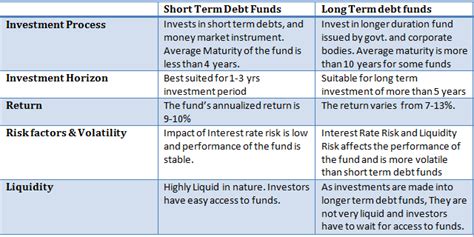

Short-term debt is any debt obligations that a company needs to pay back within the next 12 months or within the current fiscal year. It includes accounts payable, lease . Short-term debt, also called current liabilities, is a firm's financial obligations that are expected to be paid off within a year. Learn about the types, measures, and implications of. Short-term debt is any debt obligations that a company needs to pay back within the next 12 months or within the current fiscal year. It includes accounts payable, lease payments, wages, income taxes payable, and short-term bank loans.Learn what short-term debt is, how it differs from long-term debt, and what types of debt are included in it. Find out how to assess a company's debt using financial ratios and metrics.

Learn what short/current long-term debt is and how it's reported on a company's balance sheet. Find out the difference between short- and long-term debt, and see an example of how to.Short-term debt is a financial obligation that must be repaid within a year. Learn about the types of short-term debt, such as short-term loans, commercial paper, and accounts payable, and the advantages and disadvantages of using them.Short-term debt is typically used to finance a company's day-to-day operations, such as purchasing inventory, meeting payroll, and covering other immediate expenses. The use of short-term debt allows companies to maintain flexibility and . Current liabilities are short-term financial obligations that are due within one year or within a normal operating cycle. Learn how to calculate and interpret the current ratio and the quick.

Short-term debt is the amount of a loan that is payable to the lender within one year. Other types of short-term debt include accounts payable, commercial paper , lines of credit , and lease obligations. Learn the difference between long-term and short-term debt, and how they are recorded on a company's balance sheet. See common examples of each type of debt, such as bonds, notes payable,. Learn what short-term debt is and how it affects a company's financial health and cash flow. Find out the common types of short-term debt, such as bank loans, trade credit, commercial paper, and accounts payable.

Short-term debt, also called current liabilities, is a firm's financial obligations that are expected to be paid off within a year. Learn about the types, measures, and implications of. Short-term debt is any debt obligations that a company needs to pay back within the next 12 months or within the current fiscal year. It includes accounts payable, lease payments, wages, income taxes payable, and short-term bank loans.Learn what short-term debt is, how it differs from long-term debt, and what types of debt are included in it. Find out how to assess a company's debt using financial ratios and metrics.

Learn what short/current long-term debt is and how it's reported on a company's balance sheet. Find out the difference between short- and long-term debt, and see an example of how to.Short-term debt is a financial obligation that must be repaid within a year. Learn about the types of short-term debt, such as short-term loans, commercial paper, and accounts payable, and the advantages and disadvantages of using them.Short-term debt is typically used to finance a company's day-to-day operations, such as purchasing inventory, meeting payroll, and covering other immediate expenses. The use of short-term debt allows companies to maintain flexibility and . Current liabilities are short-term financial obligations that are due within one year or within a normal operating cycle. Learn how to calculate and interpret the current ratio and the quick.

short term liabilities vs long

Short-term debt is the amount of a loan that is payable to the lender within one year. Other types of short-term debt include accounts payable, commercial paper , lines of credit , and lease obligations. Learn the difference between long-term and short-term debt, and how they are recorded on a company's balance sheet. See common examples of each type of debt, such as bonds, notes payable,.

where can i buy ysl primer all hours

short term liabilities examples

LOUIS VUITTON Official USA site | LOUIS VUITTON

short-term debt & capital lease obligations hermes|short term liabilities examples